ATTENTION: Want to Learn Affiliate Marketing from Successful Affiliates?

Join this FREE community where successful marketers share their secrets!

Learn directly from highly successful affiliate marketers

Access free, actionable training content regularly

Connect with an active community of over 5,000 members

Network with multiple six-figure earning affiliates

Get your questions answered by real experts

JOIN FREE NOW!

ATTENTION: Want to Learn Affiliate Marketing from Successful Affiliates?

Join this FREE community where successful marketers share their secrets!

Learn directly from highly successful affiliate marketers

Access free, actionable training content regularly

Connect with an active community of over 5,000 members

Network with multiple six-figure earning affiliates

Get your questions answered by real experts

JOIN FREE NOW!

Popular Affiliate Marketing Payment Methods

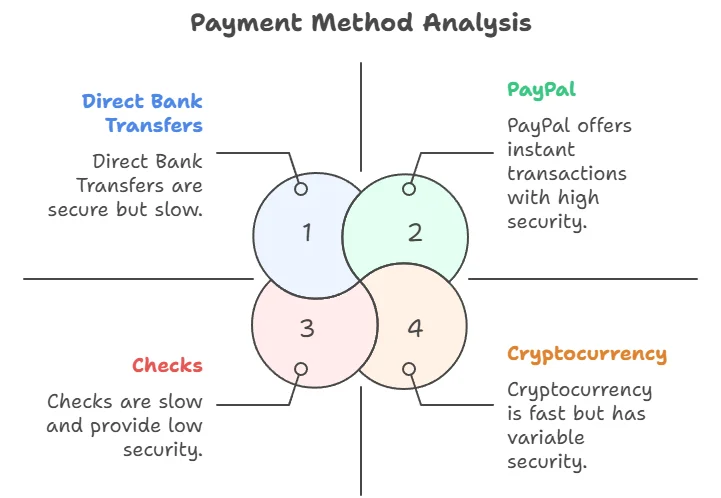

Choosing the right payment method is crucial for ensuring that you receive your commissions efficiently and securely. Here is a list of some of the most common Affiliate Marketing Payment Methods used in affiliate marketing:

- Direct Bank Transfers: Many companies prefer to deposit earnings directly into your bank account. This method is straightforward and offers low fees, making it a popular choice among affiliates.

- PayPal: PayPal is one of the most widely used payment platforms worldwide. It provides a secure way to receive payments and is easy to set up. Many affiliate programs support PayPal for instant withdrawals.

- Checks: Though less common today, some affiliate programs still offer payment via checks. This method may lead to delays, as you need to wait for the check to arrive by mail.

- Wire Transfers: For high earners, wire transfers can be a suitable option. They are typically secure and fast but might incur higher fees depending on the service used.

- Cryptocurrency: As digital currencies gain popularity, some affiliate programs have started to offer payouts via cryptocurrencies like Bitcoin. This option can appeal to tech-savvy individuals and provide added flexibility.

Factors to Consider When Choosing Payment Methods

When selecting a payment method for your affiliate earnings, consider the following factors:

- Speed of Payment: Some Affiliate Marketing Payment Methods offer instant transactions, while others might take days or weeks. Think about how quickly you need access to your earnings.

- Fees: Always check the transaction fees associated with each method. Some services may charge fees, especially for international transfers.

- Currency Conversion: If you’re working with international programs, be aware of any currency conversions and related fees, as they can impact your overall earnings.

- Security: Choose methods that provide robust security measures to protect your financial information. PayPal and similar services typically offer buyer protection, which can be reassuring.

Best Payment Methods for Beginners

For those just starting their journey in affiliate marketing, some Affiliate Marketing Payment Methods can be more user-friendly than others. Here are a few recommendations:

- PayPal: Its popularity and ease of use make it ideal for beginners. Setting up an account is straightforward, and many affiliate programs readily accept it.

- Direct Bank Transfers: If you prefer a traditional approach, this method ensures that your earnings go directly into your bank account.

- Payoneer: Similar to PayPal, Payoneer is a great option for international users. It supports multiple currencies, facilitating global payments and access to local bank accounts in several countries.

| Payment Method | Speed | Fees | Security |

|---|---|---|---|

| Direct Bank Transfers | 3-5 Days | Low | High |

| PayPal | Instant | Varies | High |

| Checks | 1-2 Weeks | Low | Medium |

| Wire Transfers | 1-3 Days | High | High |

| Cryptocurrency | Instant | Varies | Medium |

As you embark on your affiliate marketing journey, being well-informed about the various Affiliate Marketing Payment Methods available will empower you to make informed decisions. Make sure to research the options that align with your preferences and financial goals. The right payment method can enhance your affiliate marketing experience, making it smooth and efficient. Explore these payment choices thoroughly, so you can focus on what matters most—building your affiliate marketing business and driving conversions! For more detailed information about affiliate payment strategies, you can visit websites like Affiliate Programs and Ahrefs Blog.

The Impact of Payment Processing Fees on Affiliate Earnings

In the affiliate marketing landscape, understanding how payment processing fees affect your earnings is crucial. These fees can significantly chip away at the commission you earn from sales. Learning how they work and what you can do to minimize their impact can put more money in your pocket. These fees are a crucial part of any discussion of Affiliate Marketing Payment Methods.

Types of Payment Processing Fees

Payment processing fees vary widely depending on the payment method used by both merchants and affiliates. Here are some common types:

- Transaction Fees: Charged by payment gateways each time a transaction occurs. This can be a flat rate or a percentage.

- Monthly Fees: Some platforms charge a subscription fee for using their services, impacting your earnings over time.

- Chargeback Fees: If a customer disputes a charge, you may incur fees when processing the chargeback.

- Currency Conversion Fees: If you are operating in different currencies, these fees can also apply.

How Fees Affect Your Earnings

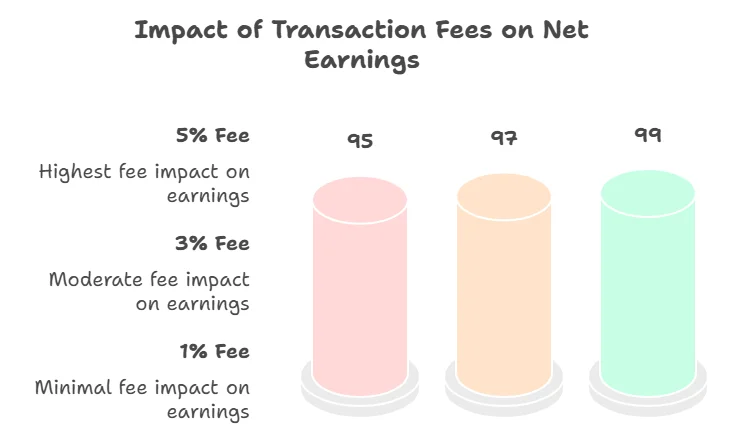

Every time a transaction takes place, a portion of your affiliate commission may disappear due to these fees. Understanding the implications is vital for maximizing your profits. Here’s a closer look at how these fees can influence your bottom line:

| Commission Earned | Transaction Fee (%) | Net Earnings After Fee |

|---|---|---|

| $100 | 5% | $95 |

| $100 | 3% | $97 |

| $100 | 1% | $99 |

For instance, if you earn a $100 commission on a sale and the transaction fee is 5%, you would take home only $95. Over time, these fees can accumulate, reducing your overall profitability. When discussing Affiliate Marketing Payment Methods, these fees are a central topic.

Choosing the Right Payment Processor

Selecting the right payment processor can significantly help in managing and reducing fees. Here are some aspects to consider:

- Fee Structure: Look for a payment processor with a transparent fee structure that does not include hidden charges.

- Payment Flexibility: Choose a processor that supports various Affiliate Marketing Payment Methods to cater to a wider audience and reduce costs.

- Service Reliability: Ensure that the processor offers timely payments and quality customer support to resolve any issues efficiently.

Strategies to Minimize Payment Processing Fees

There are effective strategies you can employ to minimize the impact of payment processing fees on your affiliate earnings:

- Negotiate Fees: If you generate considerable revenue, don’t hesitate to negotiate for lower fees with your payment processor.

- Optimize Payment Methods: Identify which Affiliate Marketing Payment Methods have the lowest processing fees and encourage your audience to use them.

- Regular Fee Review: Regularly check your current processor’s fees and compare them to others to ensure you’re getting the best deal.

One notable resource for further details on payment processing fees is PayPal, which offers various payment solutions for affiliate marketers. Another insightful platform is Stripe, which emphasizes flexibility and competitive rates.

Comparing Traditional vs. Modern Affiliate Marketing Payment Systems

In the constantly evolving landscape of affiliate marketing, payment systems play a vital role in how affiliates earn their income. As traditional methods give way to modern approaches, understanding the distinctions can help you make informed decisions about what works best for your affiliate business. This comparison is a great way to understand the various Affiliate Marketing Payment Methods.

Understanding Traditional Affiliate Marketing Payment Methods

Traditional payment methods have been the backbone of affiliate marketing for years. Many affiliates still rely on these systems due to their simplicity and reliability. Here’s a quick overview of the conventional payment options:

- Checks: One of the oldest forms of payment, checks can be mailed directly to affiliates. While secure, they often come with long waiting times and the hassle of cashing.

- Bank Transfers: Direct bank transfers allow for quick deposits to your bank account. However, they might involve banking fees that affect your earnings.

- PayPal: While popular for its convenience, PayPal often takes a percentage of your earnings in fees, which can add up.

- Wire Transfers: This method provides a high level of security, though it typically incurs higher transfer fees than other options. It is suitable for larger transactions.

While these traditional Affiliate Marketing Payment Methods offer basic functionality, they might not be the best fit for today’s fast-paced affiliate marketing realm.

Modern Affiliate Marketing Payment Methods

As the digital landscape transforms, so do payment systems. Here are some of the modern Affiliate Marketing Payment Methods that streamline the process and cater to the needs of affiliates:

- Cryptocurrency: With the rise of cryptocurrencies like Bitcoin and Ethereum, many affiliates are embracing them for payments. They offer fast transaction speeds and low fees, but the volatility can be a risk.

- Instant Payment Systems: Platforms like Skrill and Payoneer allow for near-instant payments. Their rapid transaction times keep affiliate cash flow healthy.

- Payment Platforms: Modern payment processors like Stripe and Square offer flexible payment solutions tailored for online businesses, benefiting affiliates through efficient transaction management.

Each of these modern methods provides functionality that aligns with the needs of today’s affiliates, emphasizing speed, security, and accessibility.

Comparing Fees and Processing Times

The choice between traditional and modern payment methods also involves analyzing fees and processing times. Check the following table for a concise comparison:

| Payment Method | Typical Fees | Processing Time |

|---|---|---|

| Checks | Minimal, mail costs | 1-4 weeks |

| Bank Transfers | $0-$30 per transaction | 1-3 business days |

| PayPal | 2.9% + $0.30 per transaction | Instant to 3 business days |

| Cryptocurrency | Varies, often <1% | Minutes to hours |

| Instant Payment Systems | 0.5% – 3% per transaction | Instant |

Security Considerations

When deciding on a payment method, security is paramount. Traditional systems such as checks and bank transfers are widely accepted for their perceived safety, but they may not offer robust fraud protection. More modern systems, particularly those using blockchain technology like cryptocurrency, provide high-stakes security and anonymity, yet they may still be unfamiliar to some users. Security is an important factor when considering Affiliate Marketing Payment Methods.

Choosing the Right Payment Method for Your Affiliate Business

Ultimately, the best payment method depends on your personal preferences and the specific needs of your affiliate business. Factors such as processing speed, fees, and security should all be weighed carefully. Experimentation with various systems may provide insights into which combination benefits your operations most. As affiliate marketing continues to evolve, understanding these payment systems’ core differences will enable you to operate more effectively and enhance your revenue stream.

Best Practices for Managing Your Affiliate Marketing Payments

When diving into affiliate marketing, understanding how to manage your payments effectively is crucial for your success. The right practices not only ensure you receive your earnings promptly but also help you strategize your growth. Here are key considerations and best practices to optimize how you handle your Affiliate Marketing Payment Methods.

Choose the Right Payment Method

Selecting the appropriate payment method is vital. Here are common options:

- Bank Transfers: Direct deposit into your bank account is common and secure.

- PayPal: Fast and user-friendly, suitable for many marketers.

- Wire Transfers: Useful for international payments, though often incur fees.

- Checks: Less common now but still an option for some.

- Cryptocurrency: An emerging method which can provide anonymity and lower fees.

Consider your audience and geographical factors when choosing. Some Affiliate Marketing Payment Methods may not be available in all countries.

Understand Payment Thresholds

Most affiliate programs set a minimum threshold that must be reached before a payout is issued. Familiarizing yourself with these thresholds can help you plan your marketing strategies better. You can typically find this information in the affiliate program’s terms and conditions.

Track Your Earnings Regularly

Keeping tabs on your earnings ensures you know when you are nearing the payout threshold. Utilize tools like spreadsheets or affiliate dashboards that provide detailed insights into your clicks, conversions, and earnings.

Stay Compliant with Tax Regulations

Handling payments also involves understanding tax implications. Ensure you keep your records organized and consult with a tax professional to ensure compliance with local laws. It’s essential to track earnings, expenses, and claim any applicable deductions to maximize your profits.

Utilize Payment Tracking Software

Employing payment tracking software can streamline your process. Software like Refersion or Impact can help manage your affiliate relationships and keep track of payments efficiently. Using tracking software is one of the best practices for managing your Affiliate Marketing Payment Methods.

Communicate with Your Affiliate Program Managers

Establishing a good relationship with the managers of the affiliate programs you work with can lead to smoother payment processes. When in doubt, reach out for clarification on payment timing or methods.

Protect Your Data

Security is paramount when handling financial transactions. Ensure that your chosen payment method offers robust security features. Be wary of sharing sensitive information over unsecured networks and always use strong passwords to protect your accounts.

Review Payment Processes Regularly

Take the time to review your payment processes and methods periodically. This ensures you remain updated on any changes in payment policies or new technology that could enhance your payment management.

Explore Additional Income Streams

Diversifying your income streams can help cushion against payment delays. Consider strategies like:

- Creating digital products to sell alongside your affiliate links.

- Offering services based on your expertise.

- Participating in multiple affiliate programs to spread risk.

By implementing these best practices, you can effectively manage your Affiliate Marketing Payment Methods. This will lead to better financial stability and make your affiliate marketing endeavors even more profitable. For more resources on affiliate marketing, consider visiting Affilorama and ShoutMeLoud. They provide helpful insights and tools to navigate the affiliate landscape successfully.

Future Trends in Affiliate Marketing Payment Methods

As the digital landscape rapidly evolves, so do the ways affiliate marketers are compensated. Staying ahead of the curve is crucial for both marketers and merchants. Knowing future trends in Affiliate Marketing Payment Methods can significantly impact your success. Let’s explore the changes on the horizon and what they mean for you.

Emerging Trends in Payment Methods

Affiliate marketing is shifting from traditional payment methods to innovative options that cater to a global audience. Here are some key trends:

- Cryptocurrency Payments: The rise of cryptocurrencies like Bitcoin and Ethereum is shaking up payment landscapes. With many affiliate networks exploring this option, you could soon receive commissions in digital currency. This method can offer lower transaction fees and faster payments.

- Instant Payments: Delayed payments have been a common issue for affiliates. Future trends point towards systems that enable instant payouts. This shift can improve cash flow and ensure you don’t have to wait weeks for earned commissions.

- Mobile Payment Solutions: As mobile commerce grows, payment methods tailored to mobile users are essential. Options like Apple Pay and Google Wallet allow quicker and more seamless transactions, making it easier for you to receive your earnings.

- Performance-Based Payment Models: Future affiliate programs may increasingly favor performance-based payments. This means earning more through higher sales or specific actions. Understanding this model can maximize your income potential.

The Impact of Technology on Payment Methods

Technological advancements continue to shape how payments are processed in affiliate marketing. One significant change is the integration of artificial intelligence. AI can help streamline payment processes by automating transactions and enhancing fraud detection. This means more secure and efficient payment experiences for you. Additionally, blockchain technology is gaining traction. This decentralized system offers transparency and traceability in transactions, providing assurance for both affiliates and merchants. You can expect an increase in trust as blockchain helps eliminate payment disputes. The use of technology to improve Affiliate Marketing Payment Methods is a major trend.

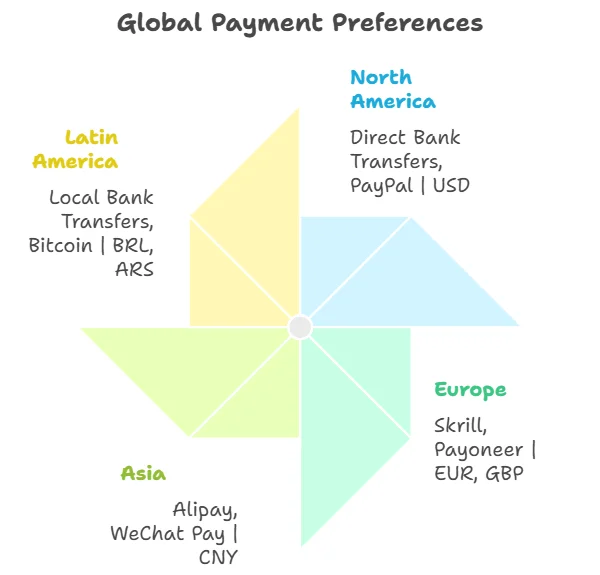

Regional Variations in Payment Preferences

With a global audience, it’s essential to recognize that payment preferences can vary significantly by region. Understanding these regional trends can help you choose the right affiliate programs. Here’s a brief look at preferences by region:

| Region | Popular Payment Methods | Preferred Currency |

|---|---|---|

| North America | Direct Bank Transfers, PayPal | USD |

| Europe | Skrill, Payoneer | EUR, GBP |

| Asia | Alipay, WeChat Pay | CNY |

| Latin America | Local Bank Transfers, Bitcoin | BRL, ARS |

By staying informed about these regional preferences, you can tailor your affiliate strategies to maximize your earnings effectively. This understanding of regional variations in Affiliate Marketing Payment Methods is important.

Valuing Security and Compliance

With all the advancements in payment methods, security is paramount. As more affiliates embrace digital currencies and alternative platforms, ensuring secure transactions becomes a pressing concern. Your ability to build trust and establish compliant relationships with payment providers will determine your success in this changing environment. Regulations concerning payments can vary, especially with digital currencies. Be sure to familiarize yourself with the laws applicable in your region. Keeping compliant ensures your affiliate business runs smoothly without legal hitches. Security is key when choosing from various Affiliate Marketing Payment Methods.

Choosing the Right Affiliate Programs

As these trends emerge, selecting affiliate programs that align with future Affiliate Marketing Payment Methods is paramount. Look for programs that prioritize innovative payment solutions. Check their payment speeds, methods, and security features. Sites like Affilorama offer resources and program reviews, helping you make informed decisions. The future of Affiliate Marketing Payment Methods presents an exciting evolution. Staying informed about payment trends can lead you to success in affiliate marketing. Embrace these changes, adapt your strategies, and watch your affiliate revenue grow.

Conclusion

Navigating the world of Affiliate Marketing Payment Methods is crucial for maximizing your earnings and ensuring a smooth financial operation. For beginners, understanding the best payment options available can greatly impact your overall success. By choosing the right methods, you can reduce unnecessary costs and efficiently manage your income.

The impact of payment processing fees cannot be underestimated, as they can eat into your profits. By comparing traditional and modern payment systems, you can find options that offer lower fees and faster transaction times, making it easier to optimize your earnings. It’s essential to stay informed about these systems, as they evolve with technology, bringing new opportunities for affiliates.

Managing your payments effectively is another critical component of success. Adopting best practices, such as maintaining detailed records and using automated tools, can streamline your financial processes and help you stay organized. This organization aids in tracking your earnings and identifying any potential issues early on. This is an important part of managing your Affiliate Marketing Payment Methods.

Looking to the future, trends in Affiliate Marketing Payment Methods suggest a shift towards even more convenient and secure options. Innovations such as cryptocurrency payments and blockchain technology may soon redefine how affiliates receive their earnings. Staying ahead of these trends can give you a competitive edge, helping you adapt to the fast-paced changes in the industry. Ultimately, understanding and optimizing your Affiliate Marketing Payment Methods is vital for long-term success. By leveraging the right strategies and staying informed about future trends, you can enhance your affiliate marketing journey and boost your earnings potential.