Finance bloggers have a fantastic avenue to monetize their content through affiliate programs. These programs not only offer chances to earn income but also provide value to your audience by recommending useful financial products or services. Below, discover some of the top Affiliate Programs for Finance Bloggers to enhance their income potential.

High-Paying Affiliate Networks

Many finance bloggers prefer joining affiliate networks that feature a variety of finance-related products. These networks can be an excellent choice for boosting your income due to their high commission rates and extensive catalog. Consider these popular options:

- Impact: This network offers various finance-related products, including credit cards and loans, with potential for high commissions.

- ShareASale: With a wide range of finance affiliate programs, it’s a go-to for many finance bloggers.

- CJ Affiliate: This network features premium offers for financial services and products that provide lucrative commissions.

Specific Programs to Consider

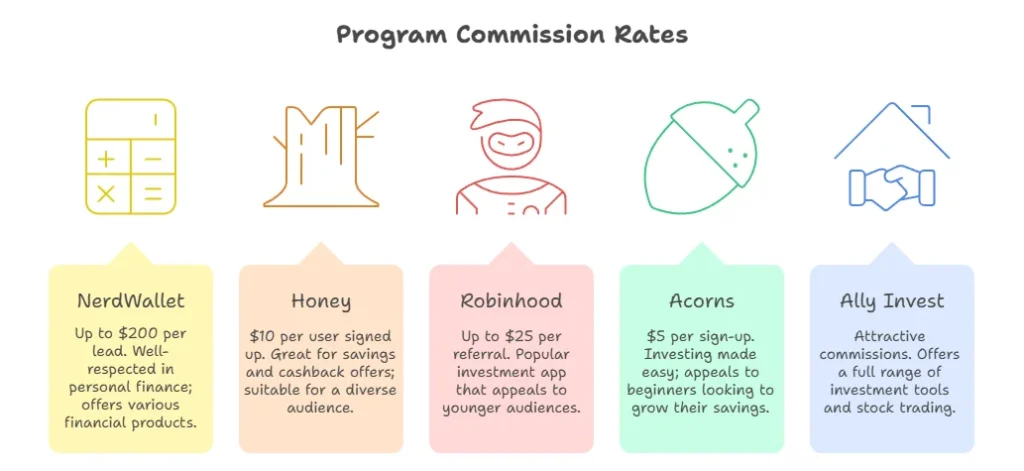

Alongside affiliate networks, certain programs specifically cater to finance bloggers looking for reliable monetization opportunities. Here are some you might want to explore:

| Program | Commission Rate | Key Features |

|---|---|---|

| NerdWallet | Up to $200 per lead | Well-respected in personal finance; offers various financial products. |

| Honey | $10 per user signed up | Great for savings and cashback offers; suitable for a diverse audience. |

| Robinhood | Up to $25 per referral | Popular investment app that appeals to younger audiences. |

| Acorns | $5 per sign-up | Investing made easy; appeals to beginners looking to grow their savings. |

| Ally Invest | Attractive commissions | Offers a full range of investment tools and stock trading. |

Platforms Preferred by Finance Bloggers

Using the right platforms can elevate your affiliate marketing game. Here are some great choices:

- WordPress: Ideal for building professional blogs with numerous plugins for affiliate marketing.

- Medium: Great for content-driven strategies while allowing affiliate links in some posts.

- Blogger: A straightforward option for beginners looking to start blogging quickly.

When selecting an affiliate program, consider your audience’s needs. Effective communication through your content is key to driving conversions. Whether writing reviews or sharing personal stories, ensure you promote products authentically.

Tracking Your Performance

To maximize your earnings, it’s essential to track the performance of your affiliate links. Many networks and programs provide analytics tools to help you see which links perform best. This allows you to focus on strategies that yield results. Consider these options:

- Google Analytics: A powerful tool to track traffic and conversions from your affiliate links.

- Bitly: Shorten your affiliate links and track their performance effectively.

Affiliate Programs for Finance Bloggers are an outstanding way to generate income. By selecting the right programs and promoting with confidence, you can provide value while earning commissions. Remember that authentic recommendations will resonate with your audience, leading to higher engagement and conversions. Start exploring these affiliate opportunities today and see how they can transform your blog into a revenue-generating platform.

Strategies for Promoting Financial Products Effectively

Promoting financial products effectively requires a blend of strategic tactics, understanding your audience, and ensuring accurate information. In an era of rapid technological evolution, it’s crucial to keep your promotional strategies relevant and engaging. Here are some effective strategies that can boost your efforts in promoting financial products.

Understand Your Audience

To promote financial products successfully, you must have a clear understanding of your target audience. Research their demographics, financial literacy, and spending habits. Tools like surveys or social media polls can be beneficial in gathering insights. Tailoring your outreach based on this data can significantly increase your chances of success.

Choose the Right Channels

Identifying the platforms your audience frequents is essential. Consider where they reside online—be it social media, blogs, or financial forums. Here’s a breakdown of popular channels:

| Channel | Description | Best For |

|---|---|---|

| Social Media | Engaging content, advertisements, and promotional offers. | Broad reach, younger demographics. |

| Blogs | In-depth articles and resources. | Building authority and trust. |

| Direct communication, newsletters. | Personalized offers and relationship building. | |

| Webinars | Interactive discussions and presentations. | Educating your audience. |

Leverage SEO Strategies

Search Engine Optimization (SEO) plays a crucial role in attracting organic traffic to your financial products. Incorporate relevant keywords throughout your content. Use tools like Google Keyword Planner to identify trending terms in finance. Make sure your website is optimized for mobile devices, as a significant amount of web traffic comes from smartphones.

Utilize Content Marketing

Engaging content can drive traffic and build trust with your audience. Here are some content types you might consider:

- Blog Posts: Write informative articles covering topics relevant to your financial products.

- Infographics: Visually represent complex financial data to make it more digestible.

- Videos: Create explainer videos that simplify financial concepts.

- Podcasts: Discuss financial topics and trends with industry experts.

Transparency is Key

Trust is paramount in the financial sector. Be open about any fees, commissions, or terms associated with the financial products you promote. Clear communication can help eliminate doubts and lead to more conversions. Always ensure your content offers value; an informative piece ranks higher in the eyes of both readers and search engines.

Engage with Your Audience

Building a relationship with your audience can lead to higher conversion rates. Respond to comments, engage in discussions on social media, and create a community around your financial products. Encourage users to share their experiences and insights. This engagement can act as valuable word-of-mouth marketing.

Partner with Influencers

Collaborating with influencers who align with your brand can provide exposure to a broader audience. Choose influencers who have a strong following in the finance niche. Their endorsements can lend credibility to your products. Make sure that they share authentic views on your offerings to avoid backlash.

Utilize Affiliate Marketing

Consider establishing an affiliate program for your financial products. With a well-crafted affiliate marketing strategy, you can reach out to finance bloggers and industry experts who can help promote your offerings. This not only broadens your market reach but also allows for incentivized promotion.

For finance bloggers looking for affiliate programs aligned with their niche, platforms like FatWallet or Awin can provide beneficial partnerships. Being part of a network that already has a strong reputation in financial services can enhance your visibility.

Research Program Reputation

The credibility of the affiliate programs you choose matters. A trusted program not only enhances your authority but also keeps your readers engaged. Consider these factors:

- Brand Recognition: Established brands usually yield better trust from your audience. Programs like NerdWallet or Robbie Atkins are well-known in the finance niche.

- Payment Terms: Learn about the commission structure. Do they pay per sale, lead, or click? Choose programs with favorable terms for your niche.

- Support and Resources: Good affiliate programs provide marketing materials, affiliate managers, and dedicated support. This can help you greatly in promoting their products effectively.

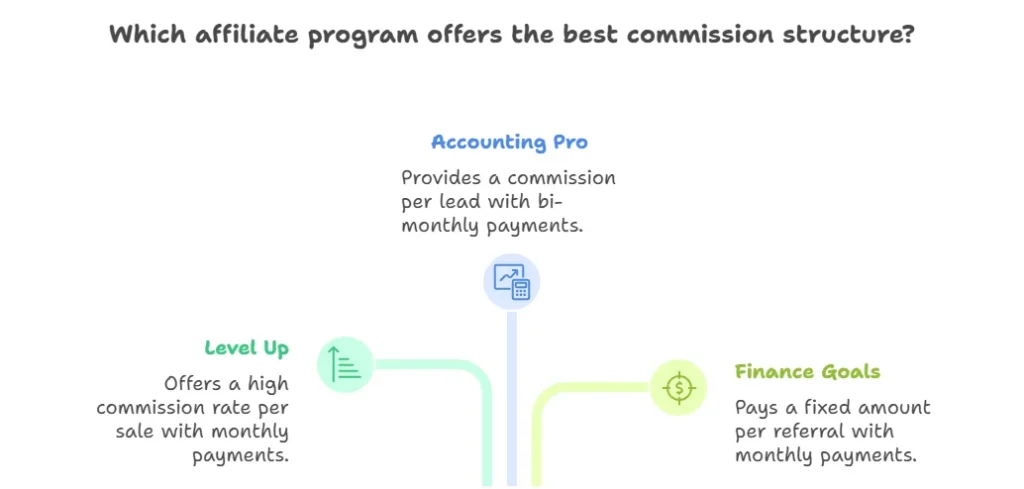

Evaluate Commission Rates

Another crucial factor to consider is the commission structure of the affiliate programs:

| Program | Commission Structure | Payment Frequency |

|---|---|---|

| A Level Up | 30% per sale | Monthly |

| Accounting Pro | 25% per lead | Bi-monthly |

| Finance Goals | $50 per referral | Monthly |

Opt for programs offering higher commissions related to the finance products your readers are interested in. This can increase your revenue significantly.

Compatibility with Your Content

The affiliate programs you choose should fit naturally into your content. Authenticity is key. You can consider:

- Product Relevance: Only promote products that align with the topics you cover. If you write about budgets, consider programs that offer budgeting tools or apps.

- Content Format: Ensure that the promotional materials they provide suit your writing style—whether it’s blog posts, reviews, or guides.

- Audience Trust: If you promote products purely for profit, your audience may lose trust. Stay genuine!

Check for Marketing Materials

Good affiliate programs provide a variety of marketing materials. This includes:

- Banners and graphics

- Text links

- Email templates

- SEO keywords and tips

Having access to quality marketing materials can enhance your promotional efforts and save you valuable time.

Analyze Performance Metrics

Once you start promoting affiliate programs, keep analyzing your performance metrics. Look for:

- Click-through rates (CTR)

- Conversion rates

- Return on investment (ROI)

Use this data to refine your strategy and focus on what works best for your audience. If a certain affiliate program isn’t performing, don’t hesitate to switch gears.

By following these strategies, you increase your potential for success in affiliate marketing as a finance blogger. Remember, the key is to align your choices with your audience’s needs and your blog’s values. The right affiliate programs can significantly boost your income and provide valuable resources to your readers.

Building Trust with Your Audience When Sharing Affiliate Links

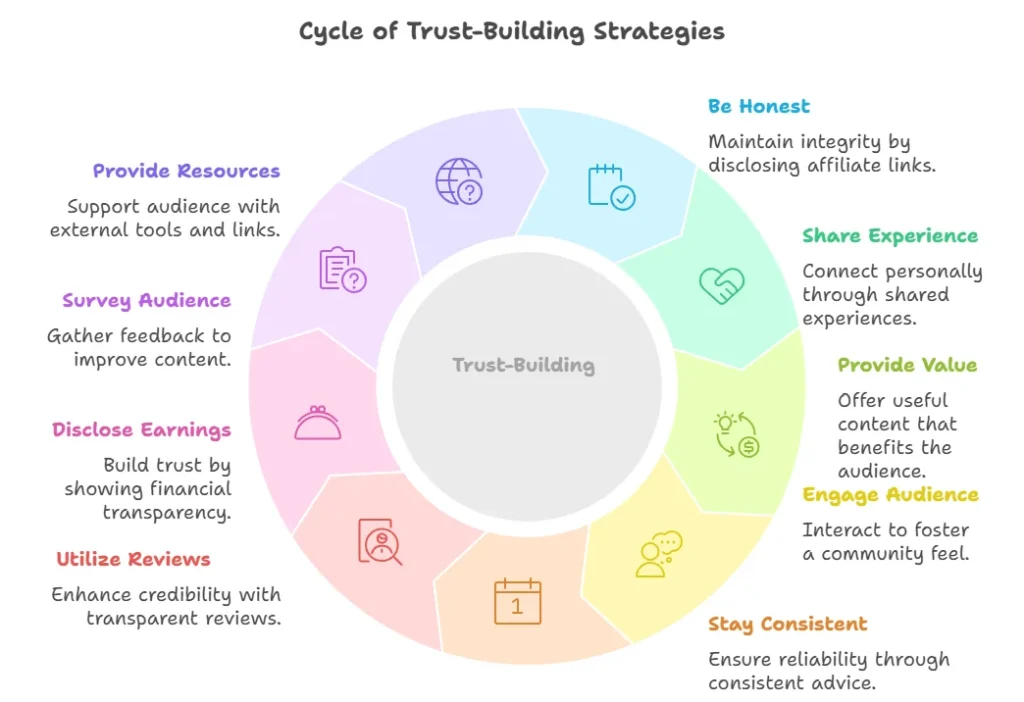

Engaging with your audience transparently is crucial when sharing affiliate links. If you want to succeed as a finance blogger, establishing trust is essential. Here are proven strategies to build that trust effectively.

Be Honest About Affiliate Links

When you include affiliate links in your content, it’s vital to communicate that clearly to your readers. Being upfront about your affiliations helps demonstrate integrity. Here’s how to do it:

- Clearly label affiliate links. Use phrases like “This link is an affiliate link” or “I may earn a commission at no extra cost to you.”

- Share your motivation. Explain why you recommend a particular product or service and how it helped you or can help your audience.

Share Your Personal Experience

Your personal anecdotes can effectively illustrate the value of a product or service. Readers want to know how it impacted you. Discussing your genuine experiences with the financial products you’re promoting fosters a connection with your audience. Consider these points:

- Include specific results you achieved using the product.

- Be candid about any challenges or drawbacks you experienced.

This way, readers feel they are receiving valuable insights rather than a sales pitch.

Provide Clear Value

When sharing affiliate links, your primary goal should be to provide value to your audience. The more value you offer, the more trust you’ll build. Follow these steps:

- Include educational content around the affiliate product. For example, if you promote a budgeting app, share budgeting tips alongside the link.

- Create how-to guides or tutorials. Walk your audience through incorporating the product into their financial planning.

By giving useful and relevant information, your audience will appreciate your recommendations more.

Engage with Your Audience

Building trust doesn’t happen in a vacuum. You need to interact with your audience to make them feel valued. Here’s how:

- Respond to comments. Taking the time to reply shows that you value your audience’s opinions.

- Encourage discussions. Ask questions related to the products you recommend and invite readers to share their experiences.

Engaging builds a sense of community, making readers more likely to trust your recommendations.

Stay Consistent with Recommendations

Consistency is key to forming trust. When recommending affiliate products, make sure they align with your values and expertise. Here are suggestions to maintain consistency:

- Only promote products you genuinely believe in and use.

- Regularly update your audience on any changes to the products or services you recommend.

This not only assures your audience that you’re knowledgeable, but it also reinforces their trust in your judgment.

Utilize Transparency Reviews

Consider creating in-depth reviews for each product you promote. Transparency is powerful. In your reviews:

- Discuss the product’s pros and cons.

- Include both positive outcomes and any negative experiences you encountered.

This balanced approach weighs your reviews and builds credibility.

Disclose Your Earnings

If possible, share your earnings from the affiliate links. Sources like The Penny Hoarder provide transparency by sharing how much they earn from affiliate programs, making readers more inclined to trust them.

Regularly Survey Your Audience

Understanding your audience is crucial. Periodically survey your readers to get feedback on what they want or need. This involvement can improve content relevance and increase trust. Consider these methods:

- Use polls via your website or social media channels.

- Encourage open-ended feedback via email or comments.

Provide External Resources

Linking to external resources further establishes your credibility. Quality backlinks can guide your audience to independent reviews and information about products. For financial advice, links to credible sources such as Investopedia can give your recommendations greater authority.

Building trust when sharing affiliate links doesn’t have to be complex. By being honest, providing value, engaging actively with your audience, and maintaining consistency in your recommendations, you can foster a loyal readership. With the right approach, affiliate programs can be a win-win for both you and your audience.

Measuring the Success of Your Affiliate Marketing Efforts in Finance

In the world of finance blogging, affiliate marketing can be a substantial income source. Measuring the success of your efforts is essential for ensuring that you maximize your earnings and improve your strategies. You must actively track key metrics to evaluate how well your affiliate programs are performing. Here, we will explore various methods for measuring the success of your affiliate marketing strategies in finance.

Key Performance Indicators (KPIs) to Track

Your success in affiliate marketing primarily revolves around understanding and analyzing key performance indicators (KPIs). Here are several critical KPIs that can help you gauge your performance:

- Click-Through Rate (CTR): This metric shows the percentage of visitors who click on your affiliate links. A higher CTR indicates that your audience finds your content engaging and relevant.

- Conversion Rate: This measures the percentage of clicks that lead to conversions, such as purchases or sign-ups. A robust conversion rate signifies that your audience is not just clicking but also taking action.

- Average Order Value (AOV): This figure reflects the average amount spent by customers who complete a purchase through your affiliate link. Tracking AOV can give insights into the effectiveness of the products and services you promote.

- Return on Investment (ROI): Calculate your ROI to determine how much profit you’re making relative to your expenses. This will help you assess the overall viability of your affiliate programs.

- Customer Lifetime Value (CLV): Understanding how much value a single customer brings over their relationship with your affiliate program is crucial. This metric aids in making informed decisions about your marketing expenditures.

Tracking Tools and Resources

To measure the success of your affiliate marketing efforts effectively, you need the right tools. Here are some popular options:

- Google Analytics: This powerful tool can help you track traffic sources, user behavior, and conversions on your site. You can set up goals to measure conversions related to your affiliate links.

- Affiliate Network Dashboards: Major affiliate networks often offer dashboards that provide real-time data on clicks, conversions, and commissions. Make sure to leverage these resources.

- Link Cloaking and Tracking Plugins: Use plugins for WordPress such as Pretty Links or ThirstyAffiliates to cloak your links and track metrics around clicks and conversions.

- Spreadsheets: While they are not as sophisticated, manually tracking your results using a spreadsheet can help you analyze trends over time.

Analyzing Your Results

Measuring success is not just about collecting data—it’s about analyzing it. Here are some tips for effectively interpreting your affiliate marketing performance:

- Identify Trends: Look for upward or downward trends in your KPI metrics. Consistent patterns can indicate whether your strategies are working or need adjustments.

- Segment Your Audience: Analyze which segments of your audience respond best to specific affiliate products. Focusing your efforts on the right demographic can improve your overall performance.

- Perform A/B Testing: Frequently test different content formats, CTAs, and affiliate products. This will allow you to identify what resonates best with your audience.

Optimizing Your Strategy

Once you have gathered and analyzed your data, it’s time to optimize your strategies. Here are some actionable steps:

- Focus on High-Performing Products: Concentrate your efforts on promoting affiliate products that yield the highest conversion rates and commissions.

- Enhance Content Quality: Regularly update your blog posts and guides to keep content fresh and relevant. This can help increase organic traffic and, consequently, your affiliate earnings.

- Implement SEO Best Practices: Optimize your content for search engines to improve visibility. This includes using relevant keywords, improving page speed, and building backlinks.

As a finance blogger, leveraging affiliate programs can be a lucrative way to monetize your content. By carefully measuring your success and continuously optimizing your strategies, you will see your affiliate marketing efforts flourish over time. Remember that the key to success lies in staying informed, experimenting, and adjusting your techniques as needed.

Future Prospects

The landscape of affiliate marketing is always changing, especially in finance. Staying ahead of trends and continuously educating yourself will keep your strategies up to date.

Ultimately, measuring your affiliate marketing success in finance involves a blend of data analysis, strategic optimization, and staying informed about industry trends. As you enhance your skills, you’ll be better equipped to drive your financial blogging journey toward greater profitability.

Conclusion

Successfully navigating the world of Affiliate Programs for Finance Bloggers can significantly enhance your income while providing real value to your audience. By exploring top affiliate programs tailored for finance, you’ve identified opportunities that not only align with your niche but also resonate with your readers’ needs. Remember, promoting financial products effectively requires a thoughtful approach—highlight the benefits, share personal experiences, and make the content engaging to capture attention.

Choosing the right affiliate programs is crucial for maintaining relevance in your niche. Focus on partnerships that reflect your expertise and your audience’s interests. This alignment fosters trust and credibility, enabling you to build authentic relationships with your readers. Trust is vital when sharing affiliate links. Transparency about your affiliations reassures your audience that you genuinely care about their best interests.

Equally important is measuring the success of your affiliate marketing efforts. Regularly analyze your performance metrics to understand what strategies work best and make informed adjustments. Using insights from your data can help you optimize content, refine your target audience, and ultimately, increase your earnings.

By combining these elements—selecting the right programs, promoting them effectively, building trust, and measuring success—you position yourself for growth in the finance blogging space. Embrace these strategies, and you’ll not only maximize your affiliate revenue but also provide valuable resources to your audience, creating a win-win situation for both you and those who follow your finance journey.